![Tax Deductions For Owner Operator Truck Drivers [Infographic] Tax Deductions For Owner Operator Truck Drivers [Infographic]](https://www.roadmastersins.com/wp-content/uploads/2022/10/truck-driver-tax-deductions-cover.jpeg)

![Tax Deductions For Owner Operator Truck Drivers [Infographic] Tax Deductions For Owner Operator Truck Drivers [Infographic]](https://www.roadmastersins.com/wp-content/uploads/2022/10/truck-driver-tax-deductions-cover.jpeg)

Tax Deductions For Owner Operator Truck Drivers [Infographic]

10.13.2022

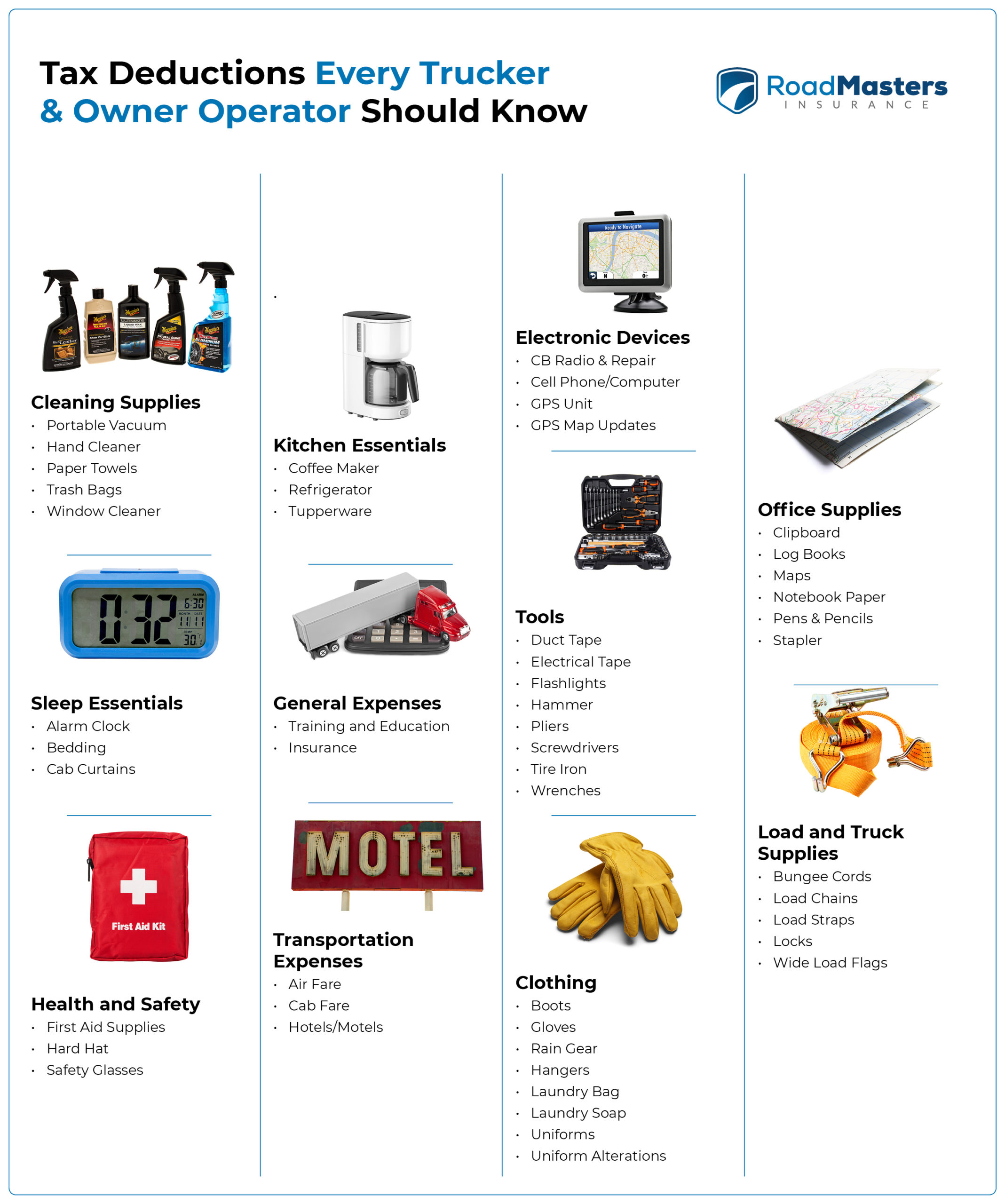

50 Tax Deductions Every Trucker & Owner Operator Should Know [Infographic]

If you work as a self-employed truck driver, you know how important it is to save as much money as possible come tax time. You may also be familiar with the most common deductibles to use during tax time: Mileage, truck repair, and even union dues.

However, the good news is that there are dozens more deductibles you may be qualified to take come tax season, and they can add up to BIG savings. Check with your tax preparation professional and see if any of these 50 deductibles apply to you!